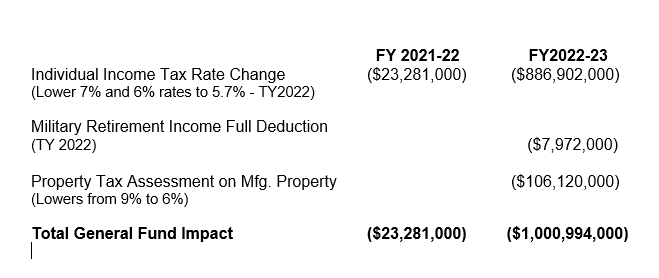

| Two weeks ago, I was given the opportunity to join a contingency (thanks to Senate President Thomas Alexander) that raised the Clemson flag over the South Carolina State House. The flag was raised on “Clemson Day” in honor of the Clemson men’s soccer team that won the NCAA National Championship in December. It was my first time in the dome of the state house. The last climb is about four floors of a spiral staircase, which leads to a platform, about 18 inches wide, that goes around just under the base of the top dome. From there it’s about a 12-step ladder to the top level. (As we made the climb, I kept hearing “3-point contact” in my head -two hands and a foot, or two feet and a hand). I also had the opportunity to speak later that morning with Rep. Jason Elliott at a breakfast meeting of all those attending from Clemson. The day actually served as a nice break to what has been a very busy few weeks since my last newsletter. The Senate has passed bills regarding the Convention of States, the South Carolina Hands Free Act, stiffer penalties on trafficking fentanyl, a bill for the minor victims of sex trafficking, a bill to help surviving spouses of veterans and those killed in action, and many more. The details on these bills can be found below under “The Weeks in Review.” We also gave second reading on Thursday to S.1087 – the Comprehensive Tax Cut Act of 2022 – sponsored by Chairman Harvey Peeler and co- sponsored practically by the entire Senate (myself included), that puts one billion dollars back in South Carolinians’ pockets. I was fortunate enough to serve on the sub-committee for this bill. The primary issues discussed were just what you would think, including: 1. How much extra money do we have? 2. Why do we have extra money? 3. If we accomplish everything in this bill, will we have enough money to fund our other critical needs in the state? The short answer to all three questions is “yes”. The bill takes our tax rate of 7% (the highest in the Southeast) immediately down to 5.7%. It eliminates all state tax on military retirement income, which is needed not only because it matters that we are ” veteran friendly” when it comes to our military bases being reviewed, but because this attracts the kind of workforce we want in South Carolina. Scroll to the bottom for a brief summary of the total one billion dollar tax cut. It’s also not lost on the Senate that many people are still suffering, not so much because of the pandemic now, but because of the 6% inflation rate and the cost of gas (which is why the refund was included). The refund will range from $100 to $700, for a total of almost one billion dollars. Just remember, this bill is on the way to the House now, so it’s not final yet. For lake property owners, it might interest you to know we sent a bill that extends the no-wake zone from 50 feet to 100 feet around docks on area lakes (primarily upstate) to the Governor last week for his signature. You will see more messaging from DNR on that once the bill is signed. Despite all we have done, we still have plenty to do, including the budget on the Senate side. I thought it was fitting that after we got second reading on the tax cut bill, Chairman Harvey Peeler got up and thanked everyone for their support. He then ended up – almost singing – “We’ve only just begun!” As always, I want to thank you again for the opportunity to represent District 8 in the SC Senate. It is an honor and a privilege that I do not take lightly. If there is anything I can do to help you navigate state government or if you just want to share your thoughts and concerns, please call my Columbia office at (803) 212-6148 and either me or my assistant, Ja’Vell Bynoe, will be happy to help you out. The Weeks in Review For more details on the bills mentioned above and the activity of the State Senate, click below: FEBRUARY 21 – 25, 2022 FEBRUARY 28 – MARCH 4, 2022 MARCH 7- MARCH 11, 2022 Proposed One Billion Dollar Tax Cut: |

Recent Posts

Archives

- July 2024

- June 2024

- April 2024

- March 2024

- February 2024

- January 2024

- June 2023

- April 2023

- March 2023

- January 2023

- November 2022

- June 2022

- April 2022

- March 2022

- February 2022

- January 2022

- May 2021

- March 2021

- February 2021

- January 2021

- October 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- January 2020

- September 2019

- May 2019

- April 2019

- February 2019

- May 2018

- March 2018

- January 2018

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- July 2015

- May 2015

- February 2014

- June 2013

- May 2013

- April 2013

- March 2013

- February 2013

Categories

- monthly newsletters (48)

- Special Report (8)

- Uncategorized (15)

Recent Comments